- Point of view

Steering pharma to future success with digital finance

Exploring finance transformation for better patient experiences

As an industry that faces continual challenges from strict regulations, high spend, and significant cost, leading pharmaceutical companies are embracing digital technology across their business operations to stay relevant and ensure patient safety.

From robots performing surgery to artificial intelligence (AI) or machine learning creating insights for clinical trials or healthcare professionals (HCP), digital technologies are laying new foundations for the pharma industry. Pharma companies are transforming internal processes to create unified operations that improve agility and flexibility, better forecast accuracy, manage regulatory risk, meet stakeholder expectations, and outperform the competition.

In an environment defined by changing patient expectations and new technologies, a performance-driven finance function plays a critical role in supporting strategic decision-making. For example, pharma companies can make smarter decisions when armed with real-time financial information, such as operating expenses or R&D investment, while tying it to patient experiences.

Transforming finance and accounting (F&A) with digital connects the entire organization – across the front, middle, and back offices and with customers, suppliers, and partners as well. For instance, with data analytics and digital capabilities, F&A can enhance patient experiences by enabling cost-effective and efficient service delivery. For example, when robotic process automation can reduce the processing time for tasks in clinical trials, such as processing clinical data management and site payments, and improve data quality for functions, such as accounts payable and spend reporting, it means faster, better, and safer drugs at lower costs for patients.

Take a copy for yourself

Digitization and the future of pharma

With more pharma companies using digital technologies to accelerate business results, the pharma sector is becoming one of the most technology-enabled industries. We see organizations embedding digital in 16 areas specific to the pharma industry, including 3-D printing of pills, smart bots for distributing medicines in warehouses, and advanced analytics for clinical trials (figure 1).

Figure 1: The role of digital in pharmaceutical companies

Digital impacts every process in the end-to-end pharmaceutical value chain, which spans R&D, manufacturing, distribution, sales/marketing, and consumer/patient interactions. Advanced technologies create competitive advantage, improve sales, and increase efficiencies across these areas. And transforming F&A with digital solutions to transform planning, reporting, and measurement fast-tracks and boosts those benefits.

Taking finance further with digital tools and predictive analysis

Despite many advances, few pharma companies have invested in technology for finance to the same level as they have for customer-facing functions. Those that have adopted digital to bring greater agility to F&A have mostly automated paper-based processes, such as electronic invoicing, but some still require human effort to validate invoices against contract terms, for example. This is changing as companies recognize that to adapt at pace they must invest in the right technologies, skills, and processes for finance to play a more strategic role while also balancing profitability and risks.

Within finance, businesses are improving productivity, speed, and integrity with digital. They're turning to the cloud, robotic process automation, AI, analytics, machine learning, natural language processing, blockchain, and more. They're generating greater insights and intelligence on, for example, supplier ROI, spend history, and payment on time.

With technology as one of the enablers of transformation, finance teams can support the business by harnessing data to integrate new insights into growth strategies. For example, more information on patient behavior or inquiries from HCPs helps companies better understand consumer sentiment.

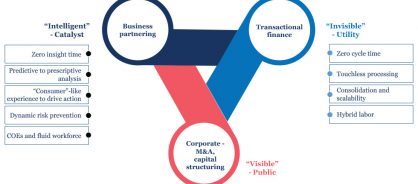

Finance is set to be led by digital technologies, making transactional activities invisible, or touchless due to automation, and other finance processes more intelligent thanks to embedded analytics and predictive insights (figure 2).

Figure 2: The future of finance and accounting

The value for companies from transforming finance with digital extends beyond productivity gains and error reduction. The future for F&A will be characterized by:

Invisible transactional finance

Automating complex tasks such as statutory reporting on costs and spend on HCPs, self-employed doctors, or professionals contracted by pharma companies can help achieve a continuous financial close where it can close the books almost on demand. When filing returns, dynamic risk prevention reduces the number of manual interventions. For example, AI can identify missing fields or errors in tax calculations and flag them for resolution. It can even auto-resolve them prescriptively.

Other examples include:

- Automating journal or invoice processing by 80%-90% with systems of engagements, robotic automation, and other technologies

- Improving supplier/customer delight with straight-through invoice processing

- Eliminating out-of-stock situations for medicines across the supply-chain cycle by updating inventory levels in real time

Intelligent processes

With a robust data strategy and governance model and predictive technologies, finance can deliver faster, relevant insights, say, about payments, disputes, and delays, with feedback loops for continuous learning. Also, AI-enabled financial forecasting can improve the accuracy of revenue projections, resource allocation, and stakeholder confidence in addition to reducing risk, variance, and forecasting cycle time.

Other examples include:

- Mobile-based reporting solutions with in-built analytics and drill-down functionality for granular insights

- User-focused reporting solutions with data visualization to decide future courses of action

- Linking financial data to operational performance and providing insights on demand for more informed decision making

As finance functions scale these developments, they will make a significant contribution to strategic decision making. For instance, by streamlining and digitizing finance, collaborating internally across functions and externally with patients and HCPs, and creating the foundations for analytics and insights, pharma companies can act on opportunities faster – and pass the benefits on to their customers or end users.

Endless opportunities through digital finance

In the face of economic and regulatory pressures, pharma companies want quicker clinical trials and drug releases, more accurate pharmacovigilance processes, superior patient outcomes, and better R&D efficiencies. The finance function plays a key role in all stages of the product development cycle from R&D to commercialization, and with robotics, AI, data analytics, machine learning, the cloud, and a hybrid workforce of man and machine, finance can enable faster insights and meaningful action. This transformation will also empower the workforce, uncover new market opportunities, and help the CFO become a strategic partner helping the business meet tomorrow's challenges.

This point of view was authored by Vivek Saxena, SVP, Service Line Leader, Finance & Accounting, Genpact.